In the GST era tenants needed to pay 6 of the rental value of a commercial property to the property owner if the propertys annual rental exceeds RM500000. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

Training Modular Financial Modeling Ii Sales Taxes Financial Statements Cash Flow Statement Modano

Meanwhile the tax rate for company is 24.

. Sale of residential property is GST exempt. You must charge GST on 1500. Total rental of the furnished flat 4500 per month.

Dividend payments are discussed later in this report. 1 on first. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

GST is generally payable before the goods are released from customs control. Goods and services tax GST applies to the supply of certain property types if the supplier seller or vendor is registered or required to be registered for GST purposes. Rent and Returns.

However developers will pay GST on some of their production inputs. Generally a company is allowed to pay pre-sale dividends. Annual value in the Valuation List 36000.

Assuming your property price on the SPA is RM700000 lets work out how much you would have to pay for the Property Stamp Duty. Malaysia GST is computed based on transaction value including insurance and freight all duties payables and other incidental charges. But many people are still unsure as to its full impact on the countrys property market especially the housing sector.

By 9 July 2015 we usher 100 days on from the start of GST one of the major pieces of tax reform the country has seen. Still to pay for 1 year. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. Only property agents on their own or work for a company who surpass an annual turnover of RM500000 per year are required to charge SST on their services provided to property buyers. Payment of tax is made in stages by the intermediaries in the production and.

However according to the guidance released by the authorities the facts. If sold after 6 years. Latest Update 2022 Professional Legal Fees.

For The First RM50000000 10 Subject to a minimum fee of RM50000 For The Next RM50000000 080. Value of exempt supply per month 112 x 36000 3000 per month. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

Issues with GST classification. March 18 2015 Henry Chin Sheh Ho. Starbucks now keeps RM15 and passes on RM030 to.

It may be viable to invest in investment property. The existing standard rate for GST effective from 1 April 2015 is 6. For non-resident individuals the income tax rate is 28.

New guidelines were issued recently by the Royal Malaysian Customs Department that includes more people being required to pay the Goods Services Tax GST when selling a commercial property The Star reported. Many thought that private properties would fall outside of this category. Sale And Purchase Agreement Legal Fees 2022 SPA Stamp Duty And Legal Fees For Malaysian Property.

Can a purchaser choose not to pay GST to the vendor. A zero rate of GST may apply for instance in cases where the recipient contracting party of the services is a non-resident and is outside Malaysia at the time. How does GST work in Malaysia.

Malaysias government recently rolled out the new Goods Services Tax GST on 1 April 2015. If sold before 5 years. In other words non-commercial properties are not subject to the 6 GST.

For resident company with paid up capital of RM25 million and below at the beginning of the basis period the tax rate for first RM500000 chargeable income is 19 reduced to 18 in YA 2017. The schedule below as a reference of stamp duty and legal fees when purchasing a house. Find out everything you need to know about Property Taxes in Malaysia.

Purchaser can easily check whether the vendor is registered under the GST from wwwgstcustomsgovmy. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

Any transfer of real estate in Malaysia attracts ad valorem stamp duty that is calculated on the purchase consideration or its market value whichever is higher. Purchaser has the right to purchase the commercial properties from a non registered vendor. Youll pay the RPTG over the net chargeable gain.

If sold before 4 years. GST is also charged on importation of goods and services into Malaysia. GST paid RM000 GST payable RM000 Scope And Charge GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person.

Value of supply of furniture and fittings per month 4500 - 3000 1500 per month. GST collection RM000 Less. Transfers of shares in an unlisted Malaysian company attract stamp duty at the rate of 03 percent of the value of shares.

Learn about these 5 different property taxes that you absolutely need to know about. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. Property sector still grappling with GST issues.

If you owned the property for 12 years youll need to pay an RPGT of 5. RPGT increases progressively as follows for commercial property. As one of the most sophisticated sectors undoubtedly property and construction industry faced greater challenges in complying with GST rules.

The businesses that perform their activities in Malaysia and internationally will have to pay SST if they exceed a particular annual. However a registered manufacturer is able to recover the GST paid on imports by. Sale of commercial properties will be subject to 6 GSTDevelopers may choose to absorb GST as part of their sales package.

And pay RM1590 RM15 6 GST. Malaysia does not impose withholding tax WHT on dividend payments. In this content we use the more common term property instead of the technical term real property.

TaxSST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. A singular and non cumulative commercial property of land that is worth more than RM 2 million. If sold within 3 years.

In the GST era tenants needed to pay 6 of the rental value of a commercial property to the property owner if the propertys annual rental exceeds RM500000. Keep in mind that tax rates change frequently and you should check the latest government information for up-to-date data. In the current tax regime the 10 Sales Tax on manufacturing and imports and 6 Service Tax on the FB and professional services industry is collected by one party usually the seller and passed on to the tax authorities.

Effective 1 April 2015 any supply of rights to use IP made in Malaysia by a GST registered person will be subject to GST of 6.

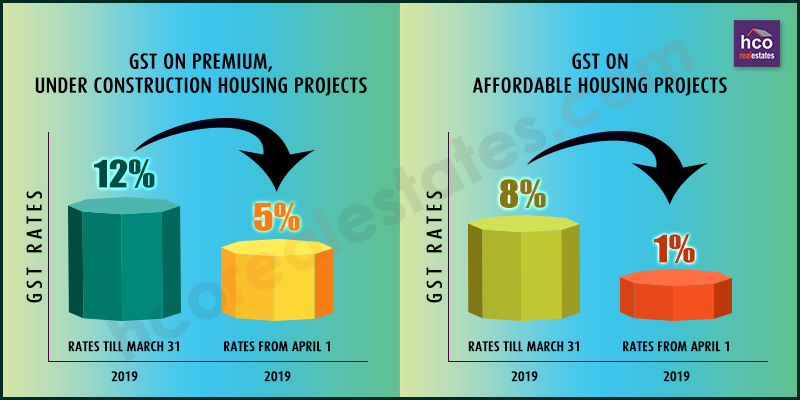

New Gst Rates And Their Impact On Indian Realty

Itc On Gst Paid For Construction Of Immovable Property Enterslice

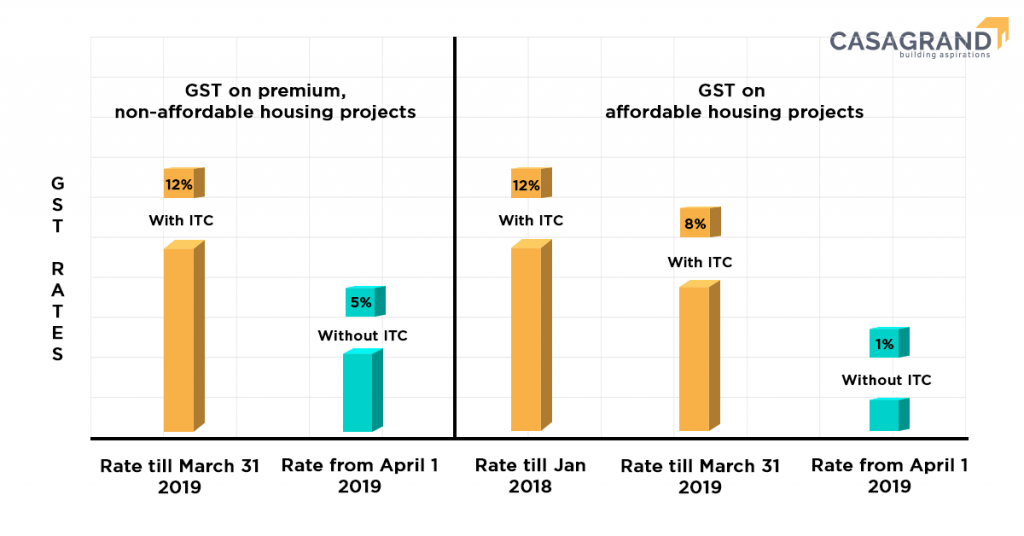

All You Need To Know About The Gst On Home Purchases

Pin On Ezee Hotel Management Solution

New Gst Rates And Their Impact On Indian Realty

Investing Investment Property Goods And Service Tax

Check Out Our Ad In Loksatta Presenting Monsoon Magic Offer Limited Period Advantage Pay 0 Gst Book Today Save Upto Rs 3 5 L Ambernath Eco Luxury Monsoon

How Gst Will Impact Home Prices The Property Market Penang Property Talk

Gst Impact On Construction Capital Costs Download Table

Gst Impact On Construction Capital Costs Download Table

How To Issue Tax Invoice Agoda Partner Hub

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Gst Impact On Construction Capital Costs Download Table

Check Out Our Ad In The Times Of India Www Paradisegroup Co In Utm Content Buffer Real Estate Marketing Postcards Real Estate Ads Real Estate Marketing Design

4 5 Bhk Apartments Shree Balaji Wind Park Residential Apartments Ahmedabad Penthouse For Sale

Impact Of Gst On Real Estate Rgnul Student Research Review Rsrr

How To Issue Tax Invoice Agoda Partner Hub

Exempt Low Cost Housing From Service Tax Under Gst Minister Venkaiah Naidu